Financial Inclusion through Financial Technology

The general concept of financial technology is the adoption of products and services by companies that are fully digitized and online in the financial sector. Financial technology has evolved into a more specific, focussed and strategic role owing to its wider objective, i.e., catering to the financial needs of the underserved; the core target segment left unserved by traditional institutions. Thus, the intention to contribute to the said segment will eventually achieve the larger goal of ‘financial inclusion’.

The Global Findex Database sheds light on how the adoption of financial services has increased over a period of time, across target segments in India. As of 2021, the Reserve Bank of India has announced an FI-Index for the period ending March 2021 has increased to 53.9 as against 43.4 for the period ending March 2017.

Along with the introduction of innovative and digital-first products and services by upstarts, government intervention through the creation and operationalization of Fintech policies, the launch of initiatives and assistance to MSMEs has also played a critical role in financial inclusion.

A brief study; Niyogin Fintech Limited

By creating a sustainable ecosystem, Niyogin is ensuring a significant impact in empowering the underserved segment.

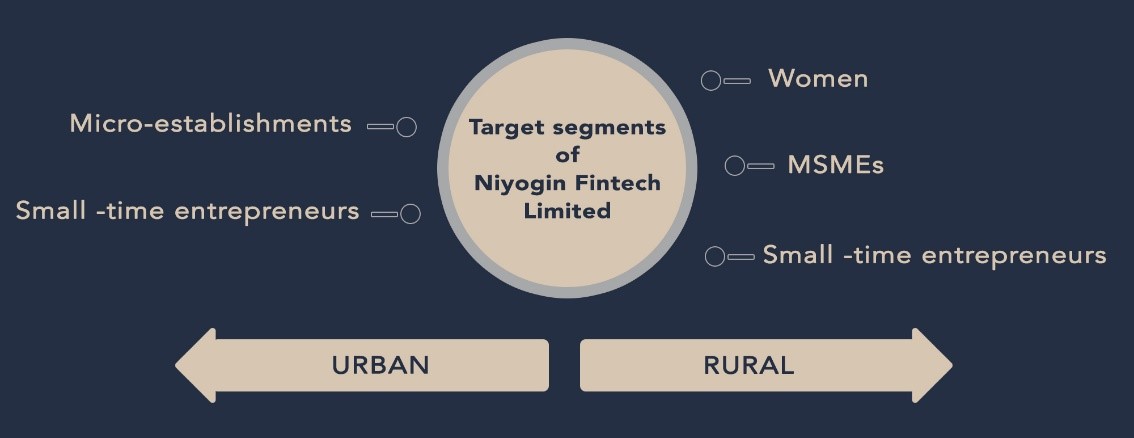

Serving the Underserved

Niyogin is reaching out to the 800 Mn+ underserved segments by devising products, services and strategies to penetrate the deepest rural India.

Network Effects

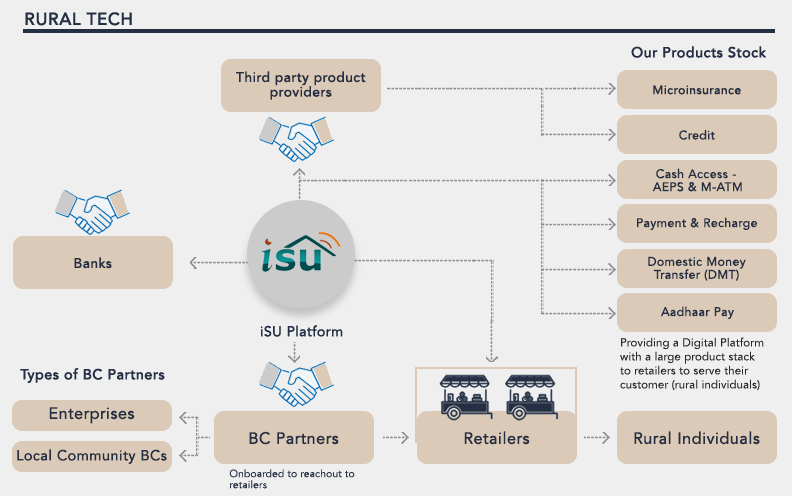

Reaching the last mile of financially underserved segments has significant cost implications. To strategically combat this challenge, Niyogin acquired iServeU in the year 2020. To enhance its reach to the rural population, Niyogin envisaged bringing banks to rural India with the help of Kirana stores and by acquiring iServeU, the low-income segments can make transactions, enquire bank balances and avail micro-loans, etc. through their Aadhaar Card.

Financial Literacy

India is the second-largest country in the world with a literacy rate of 80% yet, only 24% of the said population is financially literate. The first step towards empowering the population is by providing financial literacy. By impaneling Kirana stores in rural India, Niyogin boosts financial literacy by informing and providing individuals financial assistance. With a significant boost in onboarding rural individuals, Niyogin is achieving the vision to empower through financial technology.

Strategic Alliances

One of the ways of lowering Customer Acquisition Cost (CAC) is by developing strategic alliances with other financial institutions to offer a digital-first and seamless product and service stack. Niyogin has allied with Chqbook, iServeU, etc to leverage the reach these partners have and offer financial assistance to a larger populace.

Comprehensive Financial Services

Niyogin offers small-ticket size need-based personal loans, working capital loans to MSMEs, loans against property, loans against security and wealth management to meet the financial requirements of the population. For instance, individuals can avail personal loans ranging anywhere from 20,000-2,00,000 with a flexible repayment tenure. Its comprehensive product stack ushers a significant stride in financial inclusion.

Niyogin Fintech Limited; with a vision to empower India is catering to various segments with an asset-light architectural platform that leverages open source technology thereby shifting maximum benefits to its alliances, partners and customers.