AI Trends that will Revamp the Fintech Arena

The financial industry has transformed noticeably over the years. It revamped its traditional methods of service to be more customer-centric in its approach. To a large extent, Artificial Intelligence (AI) has been a critical enabler in this transformation.

Today, the financial industry is majorly based on building itself as a customer-centric domain and providing never-like-before customer experiences. For instance, Chatbots and virtual assistants have not only made services available 24×7 but have also improved customer service and satisfaction drastically, all while reducing costs for financial institutions.

AI also has the reliable ability to analyze customer data that enables it to create personalized financial plans along with recommendations of customized products and services that are fast, accurate, efficient and secure.

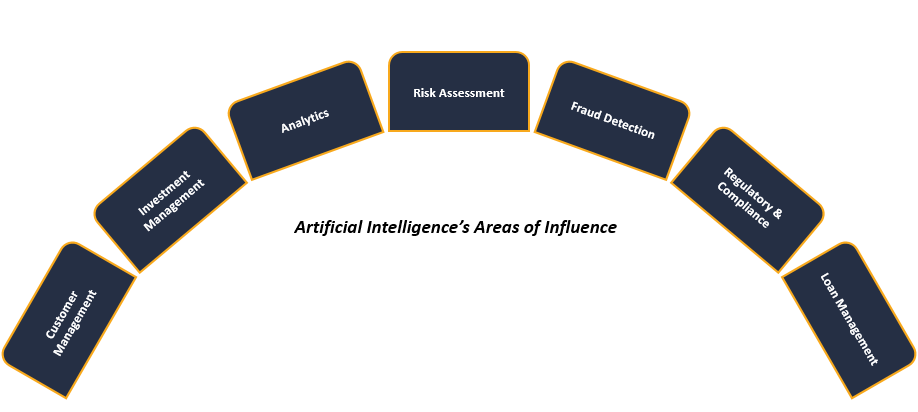

Interestingly, AI still has areas to be explored and is capable of much more than it is currently offering in the financial domain. AI brings in an amalgamation of better experience, lower costs and better growth.

Revolutionizing AI trends

There are several AI trends that have the potential to revolutionize the Fintech industry. Some of the most significant ones include –

Personalized banking experiences: With AI, fintech companies can use customer data to create personalized experiences for users. This can include personalized product recommendations, customized investment portfolios, and tailored financial advice.

For example, investment companies understand customer’s income and expenditure behaviour along with the duration of peak to low expense span. Based on this analysis along with others like your investment preference, type and need, they create an entire portfolio for you to benefit from.

Fraud detection: AI-powered fraud detection systems can analyze customer behaviour and transactions in real-time to detect any suspicious activity. This can help prevent fraudulent activities such as identity theft, money laundering, and credit card fraud. Due to the potential AI holds in the field of fraud detection, Banks worldwide are expected to spend an additional $31 billion on artificial intelligence (AI) embedded in existing systems by 2025 to reduce fraud.

Risk management: AI can help fintech companies analyze large amounts of data to identify potential risks and opportunities. This can help them make more informed decisions and manage risks more effectively. As a lender, financial institutions face huge risks in ascertaining their borrowers. AI reduces this risk significantly by creating a financial personality of the borrower by collating and analyzing various data points.

Blockchain technology: AI can be used to enhance the security and efficiency of blockchain-based transactions. This can help fintech companies offer more secure and transparent financial services.

Blockchain plays a very critical role in taking financial services to the last mile. It enables the integration of various points to build a secure and reliable marketplace for individuals far and new to the financial domain.

AI holds great potential and it is with time we shall witness the transformation it is yet to bring!