7 advantages of taking a business loan

The year FY 2020 saw a set up of 1,22,721 new businesses which grew to 1,55,377 in FY 2021 and 1,67,076 in FY 2022 at an increased rate of 7.5%. With several new businesses participating in the growth of the economy and thereby, India, it is needless to say that these enterprises must be supported and boosted.

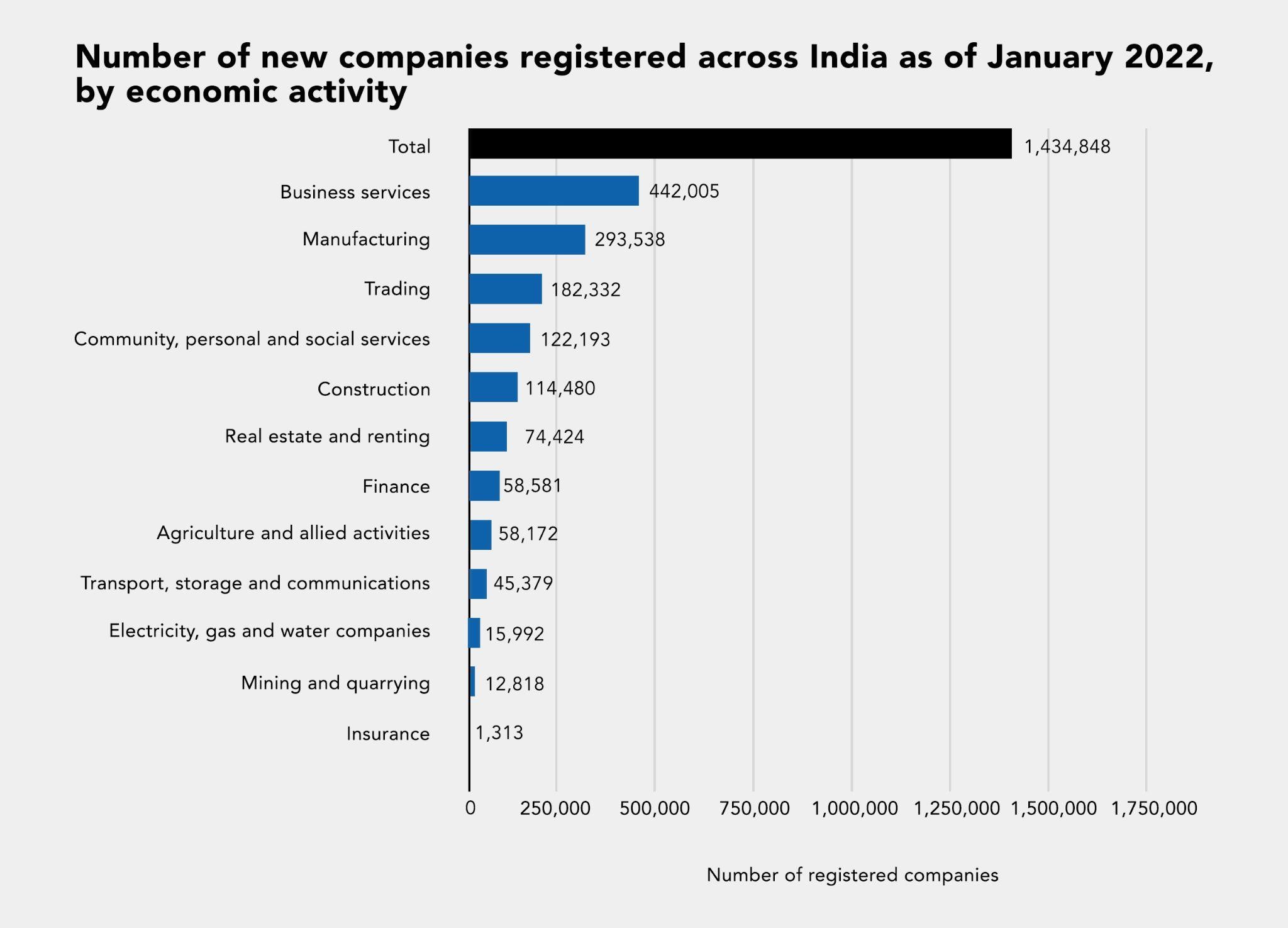

With over 14 Lakhs registered businesses and several untracked businesses, business services take the significant space followed by manufacturing and trading. Irrespective of the type of business, what stands homogenous is the need for funds.

For any business to commence, expand and thrive, capital is fundamental! Financial institutions understand this requirement for personal and economic growth and therefore, offer several types of financial services and assistance. The most common among them is Business loans specifically targeted at business needs.

Capable individuals and businesses often contemplate if they require business loans to boost their business and we’ll give you all the reasons why one must opt for it.

Tend to your Working Capital Need

Working capital is the prerequisite for the establishment, administration and sustenance of a business. Business Loans tend to these requirements and allow a business to function and flourish. However, business loans must be availed from financial institutions that are customer-centric in their approach.

Inventory Provision

A business may require funds to meet seasonal inventory needs or continuous, in both scenarios, business loans help in providing these funds at the stated time and need.

Effective Cash Management

Continuous operational activities like marketing, inventory upholding, customer acquisition and service require a continuous flow of funds that is duly inspected. Business loans enable a continuous flow of funds without having to pause or stop a business from achieving its goals. However, it is equally important to indulge in cash management to ensure funds are used efficiently.

Satisfying the Surging Demand

Businesses must always keep an eye and have the intention to scale up and meet market demands efficiently. To have a full inventory and upkeep customer demands, businesses need to have a continuous fund flow and that’s where business loans come into use. With options like OD, it’s even easy to have top-ups on loans. Financial institutions like Niyogin Fintech Limited offer top-ups at lucrative rates and tenure.

A Fixed Sum Investor

Suppose you go to ‘The Sharks’ and pitch your business idea for an investment of Rs 10 Lakhs. You will have to do away with a certain share of equity to avail of that amount whereas in business loans, your business remains entirely yours irrespective of the loan amount availed. Business loans are rather interested in extending financial support.

Avail Tax Benefits

Apart from strong funding through business loans, it also allows you to apply for tax deductions. The interest payable on a business loan is often tax-deductible depending upon the interest limit prescribed by the government. Therefore, it is in the interest of a borrower to check the eligibility criteria before applying for a business loan.

Enhanced Business Credit

Availing of business loans also means improving your business creditworthiness to apply for OD and loans in the future. However, it is important to note that to improve one’s creditworthiness, it is essential to make timely payments and repayment of the loan in its term.

Now that you know the benefits of Business Loans, do you think you want to avail one to boost your business needs? Niyogin Fintech Limited offers Business Loans that offer you the financial support you need! Contact 1800-266-0266 for more information on this matter.