Until a few years ago, technology used to be a support function for the back office of most financial organizations. Today, it is defining industry for bankers and traders. With the help of Artificial Intelligence, Neural Network, Big Data Analytics, Robotics, etc., Fintech has found its place in the innovation economy. The Role of Artificial Intelligence in Fintech sheds light on how Artificial Intelligence has become a core element in Fintech.

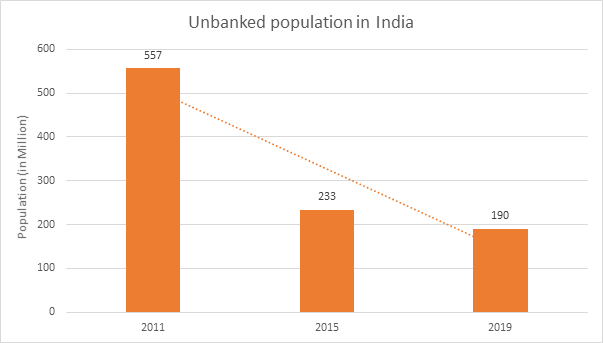

The dynamicity of Fintech has led to digitization in the financial world. It has enabled impact and customer-centric services while simultaneously widening its reach to rural India as well. The given stats showcase the growth of financial inclusiveness and fall of unbanked population in rural areas driven by adoption of Fintech powered solutions.

With a plethora of scope for further innovation and penetration, Fintech are slowly unboxing more opportunities. On the flip side, Fintech face various threats too that come with technology. Stated are a few significant opportunities and threats integrated Fintechs face-

With a plethora of scope for further innovation and penetration, Fintech are slowly unboxing more opportunities. On the flip side, Fintech face various threats too that come with technology. Stated are a few significant opportunities and threats integrated Fintechs face-

| Opportunities | Threats | |

|---|---|---|

| 1 | Rural Market- Owing to its geographical size and dispersion coupled with weak unit economics of the brick-and-mortar branch model, rural areas create a huge white space for rural centric neobanks. | Credit Risk & Collection- While Credit Risk is intrinsic to any lending proposition, rural markets come with their complications of limited collections infrastructure. |

| 2 | Expansion of distribution network- Fintech can create a unique distribution network access that offers cost-efficient market access and enables it to provide hyperlocal services. | Distribution Risk- To a large extent, distribution depends on financially weak partners, i.e., Kirana stores and this distribution channel largely depends on customer investment and hence, have a possibility to collapse without a robust customer base. |

| 3 | Financial Inclusion- With addition of new products at every level of the IndiaStack, the digital infrastructure becomes more solid paving way to more seamless services and product innovation. | Technology Risk- Outdated technology, platform downtime, data leaks, and information theft have been widespread to the extent where financial institutions bore an expense of $ 16.9 billion in Identity Theft in 2019. |

| 4 | Innovative use of Data- Fintech can devise innovative methods to leverage artificial intelligence more efficiently to generate a more detailed analysis of creditworthiness, preferences, behaviour etc. | Competition- At present, there are more than 2,100 Fintech in India with overlapping products and services. While Covid-19 proved unfavourable to several businesses, it opened new opportunities and markets for Fintech. |

Conclusion

Despite the pandemic, the Fintech domain has boomed. According to a Boston Consulting Group report released March 2021, India’s Fintech market is now valued at US$31 billion, projected to grow to US$84 billion by 2025. By providing hyperlocal solutions, Fintech have only begun powering the financial inclusion.